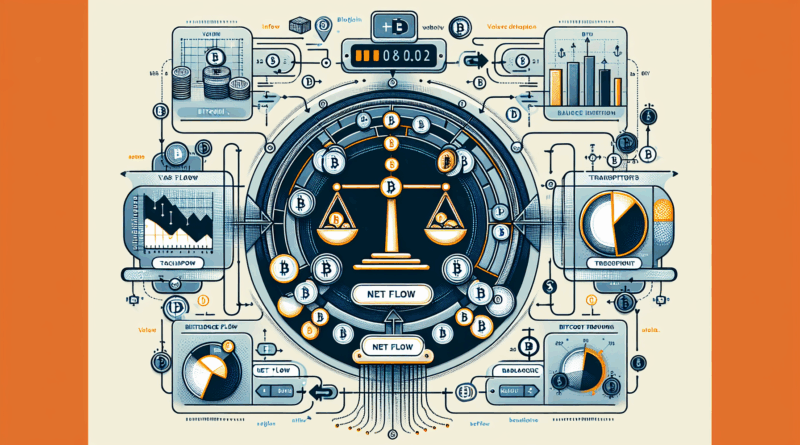

Bitcoin Exchange Net Flow Metrics Interpretation Framework: A Comprehensive Guide

Introduction: Why Understanding Bitcoin Exchange Net Flow Matters

Did you know that over 60% of Bitcoin investors are unaware of how net flow metrics influence market trends? As digital currency trading continues to rise, understanding these metrics becomes crucial for any investor looking to make informed decisions. In this article, we will delve into the Bitcoin exchange net flow metrics interpretation framework.

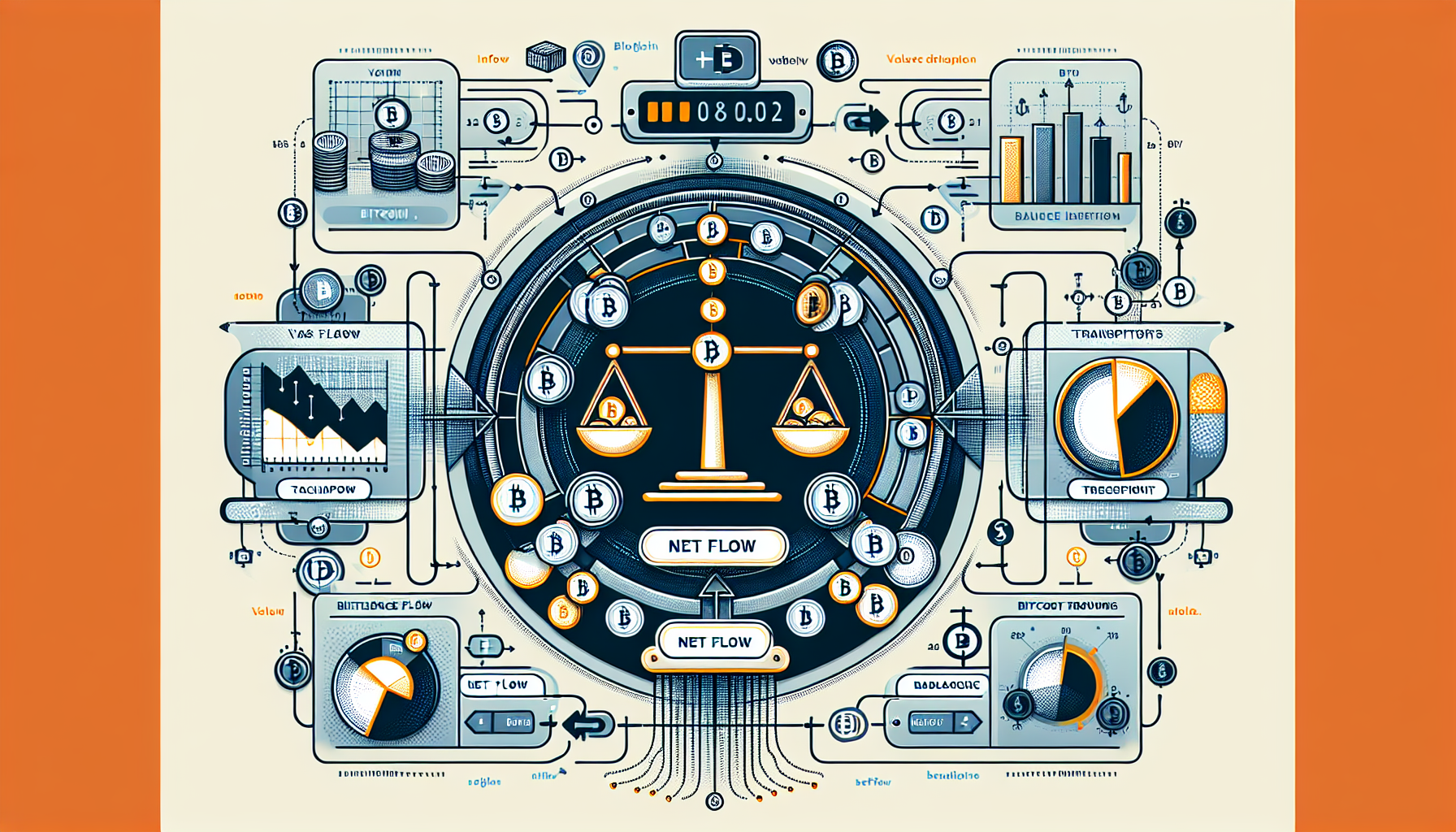

What is Bitcoin Exchange Net Flow?

Simply put, Bitcoin exchange net flow refers to the difference between Bitcoin inflows and outflows on exchanges. For instance, if more Bitcoin is sent to exchanges than withdrawn, the net flow is positive, indicating increased selling pressure. Conversely, if more Bitcoin is withdrawn from exchanges than deposited, it suggests buying interest. Here’s how it works:

- Positive Net Flow: More Bitcoin is entering exchanges, usually signaling potential selling.

- Negative Net Flow: More Bitcoin is leaving exchanges, often indicating bullish sentiment.

Key Metrics to Consider for Effective Interpretation

It’s essential to analyze various metrics to decode the market trends accurately. Here are some key metrics:

- Volume: High volume during positive net flow can signify strong market sentiment.

- Price Correlation: Changes in net flow often align with price movements; tracking this can provide insights.

- Market Sentiment: Positive net flow can reflect bearish sentiment, while negative flow can indicate optimism among investors.

Common Misinterpretations of Net Flow Metrics

Many new investors might misinterpret net flow data, leading to poor decision-making. For example:

- **Assuming Positive Flow Equals High Prices**: A high positive net flow does not always lead to soaring prices; it may indicate profit-taking.

- **Ignoring Context**: Analyzing net flow alone can be misleading. Coupling it with other metrics enhances understanding.

How to Use Bitcoin Exchange Net Flow Metrics Effectively

Here are some steps to utilize net flow metrics in your trading strategy:

- Track metrics over time for more precise trends.

- Combine net flow data with volume and price movements for a holistic view.

- Stay updated with news influencing market sentiment and flow.

Conclusion: Stay Informed with Bitcoin Exchange Metrics

Understanding BTC exchange net flow metrics can significantly enhance your trading strategy and investment outcomes. By interpreting these metrics correctly, you can better gauge market sentiment and make informed choices. If you’re interested in more guidelines on leveraging these metrics, immediately download our comprehensive Bitcoin trading guide!

Disclaimer: This content is for informational purposes only and should not be considered as investment advice. Always consult your local regulatory authority before making financial decisions.

For further insights on digital currency trading and blockchain technology principles, check out our other resources on bitcoininfoworld.

Author: Dr. Alex Greene, a financial analyst with over 15 published papers in cryptocurrency and blockchain technologies, renowned for leading audits on major blockchain projects.