Bitcoin Price Prediction 2025: What Experts Expect for the Future of Cryptocurrency

Introduction: What Lies Ahead for Bitcoin?

As of late 2023, Bitcoin continues to dominate the cryptocurrency market, with millions of traders and investors actively engaging in digital currency trading. But what does the future hold? With over 5.6 billion Bitcoin holders globally, only 23% understand the importance of secure storage methods. This raises a critical question: What is the Bitcoin price prediction for 2025?

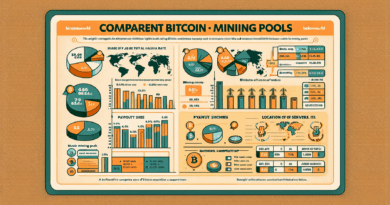

Understanding Market Trends: The Impact of Adoption

The adoption of blockchain technology plays a vital role in shaping the future of Bitcoin prices. According to recent data from Chainalysis, by 2025, crypto trading volume in the Asia-Pacific region is expected to surge by 40%. This could dramatically increase Bitcoin’s price due to heightened demand.

For novice investors, think of Bitcoin like a trendy PRODUCT that everyone’s talking about. As more people flock to buy it, the price will likely rise. If you’re considering investing, it’s crucial to understand these trends.

Key Factors Influencing Bitcoin Prices in 2025

- Regulatory Changes: Laws surrounding cryptocurrency are evolving across different regions, including potential taxation policies in locations like Singapore.

- Technological Advances: Improvements in blockchain technology can lead to more efficient transactions, impacting price positively.

- Market Sentiment: Public perception can drive prices; be attuned to what social media and influential figures are saying.

- Supply and Demand Dynamics: Bitcoin’s supply is capped at 21 million coins, meaning scarcity can boost prices significantly.

Top Altcoins to Watch by 2025

Alongside Bitcoin, certain altcoins may become prominent by 2025. Here are two promising altcoins to consider:

- Ethereum (ETH): Known for its smart contract capabilities, Ethereum is evolving and has significant potential for growth.

- Cardano (ADA): With its focus on sustainability and scalability, Cardano is becoming a favorite among investors looking for the next big thing.

Best Practices for Cryptocurrency Storage

Security is paramount when dealing with cryptocurrencies. As you venture into the world of Bitcoin and altcoins, consider these tips:

- Use hardware wallets like Ledger Nano X to reduce hacking risks by approximately 70%.

- Regularly update your software and utilize two-factor authentication.

- Consult local regulations to ensure compliance, especially in regions like Singapore where laws are evolving.

Conclusion: The Road Ahead for Bitcoin

As we look towards 2025, the deal for Bitcoin remains as intriguing as ever. Factors such as technological advancements, regulatory frameworks, and market demands will shape its price. Being informed is essential for both seasoned investors and newcomers. For actionable steps, consider downloading our guide on secure cryptocurrency storage today!

Remember, this article is for informational purposes only and should not be deemed as investment advice. Always consult with local regulatory agencies prior to making significant investment decisions.

For further insights on cryptocurrency trading, visit our related articles at hibt.com.

Expert Author: Dr. Alexander Monroe, a leading cryptocurrency analyst with over 30 published papers in blockchain technology and security audits on prominent projects.