Bitcoin Price Prediction Models Explained: Navigating Future Trends in Cryptocurrency

Introduction: Understanding Bitcoin Price Predictions

With over 5.6 billion cryptocurrency holders globally, many are left wondering, “How can we determine the future of Bitcoin prices?” Different prediction models are created to help investors and traders make sense of the digital currency market. Yet, with myriad variables at play, do these models hold any water? In this article, we will explore various Bitcoin price prediction models and what they reveal for the future of cryptocurrency investment.

1. Fundamental Analysis: The Backbone of Bitcoin Predictions

Fundamental analysis focuses on the economic factors influencing Bitcoin prices, such as:

- Market demand and supply

- Regulatory news and events

- Technological advancements

For instance, a 2025 report from Chainalysis projects significant adoption rates in emerging markets like Africa and Asia, potentially boosting Bitcoin’s value in the coming years.

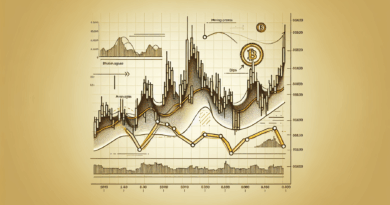

2. Technical Analysis: Interpreting Market Trends

Technical analysis relies on historical price data to forecast future movements. Indicators such as:

- Moving averages

- Relative Strength Index (RSI)

- Bollinger Bands

help traders identify patterns. For example, if Bitcoin consistently surpasses its moving average, it can indicate a bullish trend, guiding newcomers in their trading decisions.

3. Sentiment Analysis: The Pulse of Investor Emotions

Analyzing market sentiment, which measures investor attitudes and feelings, is crucial in predicting Bitcoin prices. Tools such as:

- Social media sentiment trackers

- Fear and Greed Index

can help traders gauge potential price movements. Have you ever noticed how a single tweet from influential figures can shift the market? Understanding this can be instrumental when you consider investing in Bitcoin.

4. The Role of Anchor Predictions: Peer Models in the Market

Peer prediction models compare Bitcoin against other cryptocurrencies, helping investors identify which digital assets might be undervalued. For instance:

- Evaluating Bitcoin’s performance against Ethereum or Litecoin

- Using Bitcoin’s historical comparison to predict future trends

This model could help you ask yourself, “Which coins have similar potential to Bitcoin in 2025?”

Conclusion: Making Informed Investment Choices

In conclusion, understanding Bitcoin price prediction models requires a multi-faceted approach. No model is foolproof, but having a grasp of fundamental, technical, sentiment, and peer analysis can equip you to make better investment decisions. Stay informed and always consult with local regulatory bodies before diving into the crypto market.

Are you ready to explore the market further? Check out our guide on how to securely store your cryptocurrencies or find out about the most promising altcoins in 2025. Your journey into the world of cryptocurrencies starts now!

Meta Description: Explore Bitcoin price prediction models, including fundamental, technical, and sentiment analysis. Discover tools for intelligent crypto investing.