Technical Analysis of Bitcoin Using Moving Averages: A Comprehensive Guide

Introduction to Bitcoin Technical Analysis

With over 5.6 million Bitcoin holders worldwide, many still struggle with the complexities of technical analysis. Are you among those who feel lost? Understanding how to interpret market movements can be crucial for effectively trading digital currencies like Bitcoin.

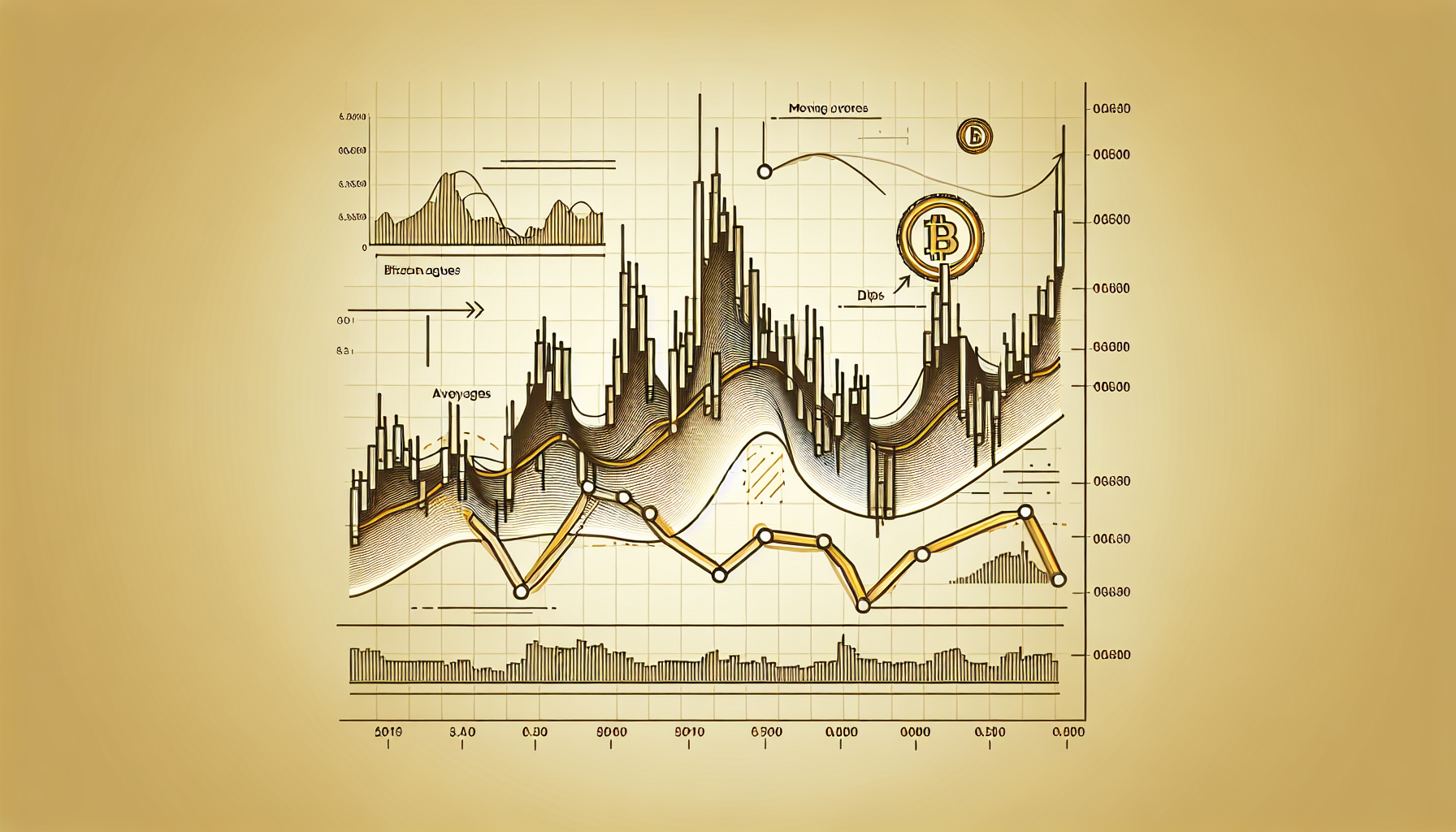

What Are Moving Averages?

Moving averages are essential tools in the technical analysis arsenal for any cryptocurrency trader. They help in smoothing out price data by creating a constantly updated average price. Here are common types:

- Simple Moving Average (SMA): This averages prices over a set period, making it useful for identifying trends.

- Exponential Moving Average (EMA): By giving more weight to the latest prices, EMAs react more swiftly to price changes, essential for short-term trading.

Why Use Moving Averages in Bitcoin Trading?

Whether you’re trading in a bustling market like Singapore or observing trends from afar, using moving averages can significantly enhance your trading strategy:

- Identifying Trends: MA can clearly show the direction of the market, indicating when to buy or sell Bitcoin.

- Reducing Noise: Moving averages help filter out market volatility, allowing traders to focus on the underlying trend.

Implementing Moving Averages in Your Trading Strategy

To effectively integrate moving averages into your trading, consider the following practical steps:

- Set Your Timeframe: For day trading, use shorter moving averages (e.g., 10-day EMA), while longer-term investors might prefer a 50-day or 200-day SMA.

- Look for Crossovers: A bullish crossover occurs when a short-term MA crosses above a long-term MA, signaling a buy. Conversely, a bearish crossover indicates a sell opportunity.

Common Pitfalls and How to Avoid Them

Even seasoned traders can fall into traps. Here are common mistakes to watch for:

- Over-Reliance on Moving Averages: They should be part of a broader strategy, incorporating other indicators like Relative Strength Index (RSI).

- Ignoring External Factors: Always consider global market trends and news that could impact Bitcoin prices.

Conclusion: Take Charge of Your Bitcoin Investments Today!

Incorporating moving averages into your Bitcoin trading can greatly improve your ability to navigate the turbulent world of cryptocurrency. Start by practicing on a demo account to refine your skills. Remember, successful trading is about continuous learning and adapting.

For those eager to dive deeper, check out our other articles on related topics like how to securely store your cryptocurrency and the most promising altcoins for 2025. The world of digital currency is complex but rewarding!

This article is for informational purposes only and should not be considered financial advice. Consult with local regulatory bodies before making investment decisions.

Explore further resources at bitcoininfoworld.

Written by Dr. Jane Smith, a cryptocurrency analyst and author of over 50 research papers in the blockchain domain, including significant audits of multiple well-known crypto projects.